1. Introduction

Internet Banking is the convenient online banking service provided by Industrial and Commercial Bank of China (Canada). Customers using our internet banking can operate their accounts and manage their financial needs anytime, anywhere.

1.1 Who can apply for Internet Banking service?

Both personal and corporate account customers can apply for this service.

1.2 What is the Security Feature?

We will provide you with a Dynamic Password Card to protect you from screenshots cracking. In the event that screenshots can crack the password, it will only crack one password out of the several passwords contained in the Dynamic Password Card. The password is different each time, so hackers are difficult to calculate the dynamic password the next time.

1.3 What is the Dynamic Password Card

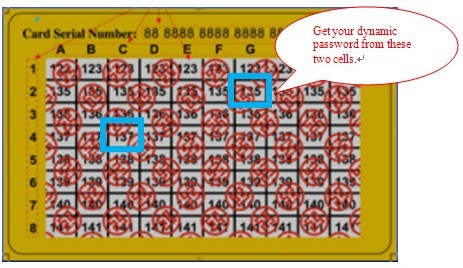

Dynamic Password Card, also known as a one-time password, is easy to use and very effective. When you are asked to enter a password in order to complete the transaction, you can find the password in the subject coordinates on your Dynamic Password Card. .

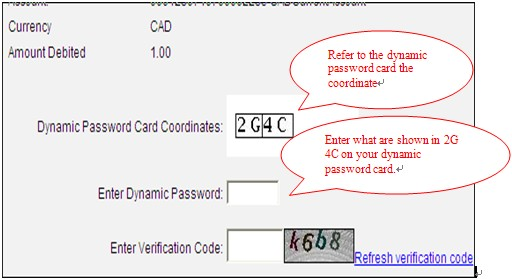

Example:

The Dynamic Password Card Coordinates shows 2G 4C. Enter the password shown in 2G 4C on your dynamic password card.

1.4 What is Internet Banking Assistance?

Internet Banking Assistance is an integrated installation package used to install Internet Banking required software.

1.5. Why do we need to install Internet Banking Assistance?

Internet Banking security controls and system patches are automatically downloaded, adjust Internet explorer setting at the same time by using Internet Banking Assistance. Otherwise, you have to install

1.6. Why do we need to install Internet Banking security controls?

Internet Banking security controls are programs developed jointly by Microsoft and the Bank to prevent hacker by means of Trojan horse program, network attack and other means to steal your Internet Banking password. Install online banking security control procedures will greatly improve your online banking security level, effectively guaranteeing the safety of your funds.

1.7 What is the service charge for Internet Banking?

Internet Banking service is free of charge.

1.8 What types of accounts can be accessed through Internet Banking?

Deposit Accounts

• CAD/USD Current Account

• CAD/USD Passbook Savings Account

• CAD RRSP Savings Account

• CAD TFSA Savings Account

• CAD/USD Cheque and Yield Account

• CAD Jumbo Yield Account

• CAD/USD Term Deposit, including RRSP Term Deposit and Swap Deposit

Loan Accounts

• Mortgage Loan

• Term Loan

• Car Loan

• RRSP Loan

• Small Business Loan

• Construction Loan

1.9 What services are available through Internet Banking?

The following services are currently available:

| Account Enquiry |

|

| Bill Payment |

|

| Global Transfer |

|

| Term Deposit |

|

| Loan |

|

| Customer Service |

|

| Information Center |

|

1.10 How, when and where can I use Internet Banking?

If you access the Internet with the recommended hardware, software and browsers, you can access Internet Banking services 24 hours a day, 7 days a week, which allows you to conduct your banking anytime, anywhere.

Some services, such as Foreign Exchange, are available before the cut-off time at 5:00 p.m. E.T. on any banking day.

2. Service Hotlines

2.1 Whom can I call if I am not able to access Internet Banking, even though I have entered my account number and PIN correctly?

You can contact any branch during business hours :

| Branch Telephone Number |

Business Hours (Local Time) | |

| Richmond Hill Branch | (Monday to Thursday) | 9:30 a.m. to 4:30 p.m. |

| Tel : (905) 882 8182 | (Friday) | 9:30 a.m. to 6:00 p.m. |

| (Saturday) | 10:00 a.m. to 3:00 p.m. | |

| Markham Branch | (Monday to Thursday) | 10:00 a.m. to 5:00 p.m. |

| Tel : (905) 940 2218 | (Friday) | 10:00 a.m. to 6:30 p.m. |

| (Saturday) | 10:00 a.m. to 3:00 p.m. | |

| Mississauga Branch | (Monday to Thursday) | 10:00 a.m. to 4:00 p.m. |

| Tel : (905) 890 2388 | (Friday) | 10:00 a.m. to 6:00 p.m. |

| Richmond Branch, | (Monday to Friday) | 9:30 a.m. to 4:00 p.m. |

| Vancouver | ||

| Tel : (604) 278 9668 | ||

| Scarborough Branch | (Monday to Thursday) | 9:30 a.m. to 4:30 p.m. |

| Tel : (416) 298 6883 | (Friday) | 9:30 a.m. to 6:00 p.m. |

| (Saturday) | 10:00 a.m. to 3:00 p.m. | |

| Vancouver City Branch | (Monday to Friday) | 9:30 a.m. to 4:00 p.m. |

| Tel : (604) 709 9668 |

3. Internet Banking Account Set-up

3.1 How can I access my Internet Banking Account?

You can simply use your Internet Banking account number and the PIN to access online banking service. For security reasons, you will be required to change your PIN when you login for the first time.

3.2 How many accounts can be linked to my Internet Banking Account?

You can link unlimited accounts to your Internet Banking Account.

3.3 What are the daily withdrawal limits for Internet Banking?

Daily Withdrawal Limits (per Internet Banking account)

| Total withdrawal limit per Internet Banking account | CAD 50,000 |

| Single transaction limit per Internet Banking account (Personal) | CAD 5,000 |

| Single transaction limit per Cyberbaning account (Corporate) | CAD10,000 |

3.4 Can I change my Internet Banking daily withdrawal limit or account limit?

For personal customer, you cannot change your withdrawal limit or account limit.

For corporate customer, you can change your withdrawal limit or account limit to a lower level by completing an amendment form at any branch.

4. Internet Banking Operations

4.1 Account Enquiries

4.1.1. What information can I obtain from the [Account Enquiry] function?

You can obtain an integrated overview of all registered bank accounts under your name, whether in your sole name or held jointly with others, including

• Account balances and transaction records of your savings, current and chequing accounts

• Principal balance of Term Deposit

4.1.2. When I check my balances and transaction history through the [Account Enquiry] function, is the information the most up-to-date?

Your account balances and transaction records are updated immediately on each banking day. They include new payments and transfers carried out at our branches or submitted through Internet Banking before 12:00 a.m. E.T on every banking day.

4.1.3. How far back can I make enquires on my transaction history using the [Account Enquiry] function?

For savings, current and chequing accounts, you can make enquiries on your transaction history up to the last 12 months (due to system upgrade in May 2011, all transaction history before May 2011 shall be enquired at our branches).

4.1.4. Can I change the cheque book style through the [Cheque Book Ordering] function?

The style and the quantity of each cheque book order you make via Internet Banking will be the same as that of your previous order. If you want to change the style and the quantity of your new cheque books, please visit one of our branches to place your order. Our branch staff will be happy to assist you.

4.1.5. How and when can I get my new cheque book?

The default dispatch method is [by mail]. If you want to pick up your cheque book in our branches, please contact our branches for assistance. New cheque books are generally ready in 2 weeks.

4.1.6. What is the charge for each cheque book order I make via Internet Banking?

The charge for new cheque books depends on the style and the quantity of your order, and will be amended from time to time. If you want to know the updated charges, you may contact one of our branches or Davis + Henderson(http://dhltd.com)for details.

4.2 Global Transfer

4.2.1. What can I perform with the [Global Transfer] function?

You can transfer funds between your own registered savings, current and chequing accounts, or from your own registered savings, current and chequing accounts to pre-designated third party accounts within Industrial and Commercial Bank of China (Canada) in the same area, e.g. from your registered account in Toronto to pre-designated third party accounts in Toronto.

In addition, you can also remit funds in this function.

4.2.2. Can I transfer or remit funds to or from my foreign currency accounts?

Yes, you can transfer or remit funds to or from your foreign currency accounts, except CNY account.

4.2.3. Can I transfer or remit funds from a joint account?

Yes, provided that your joint account operates under an 'either-to-sign' signatory arrangement. You can link your joint account to Internet Banking and then make funds transfers or remit funds to your other account(s) or to third party accounts.

4.2.4. Can I transfer funds any time of the day?

You can make funds transfers at any time during the day. Funds transfers are completed immediately.

4.2.5. Do I have to pay a transaction fee for making a funds transfer?

There is no extra service charge for making a funds transfer through Internet Banking. However, depending upon your account features, a regular transaction fee may apply. Please refer to our Charge Schedule for Personal Customers or Charge Schedule for Business Customers, whichever is appropriate, for details.

4.2.6. How can I register pre-designated third party accounts for funds transfers?

You can register pre-designated third party accounts at any of our branches during business hours.

4.2.7. Do I need to pre-register beneficiary accounts before I place remittance instructions via Internet Banking?

You do not need to pre-register beneficiary accounts before you place remittance instructions via Internet Banking. However, after the launch of our new version of internet banking in August, 2011, you need to pre-register beneficiary accounts if you choose “Yes” in Session “Transfer Funds only to Pre-designated Third Party”

4.2.8. What is the service charge for each remittance instruction?

Please refer to our Charge Schedule for Personal Customers or Charge Schedule for Business Customers, whichever is appropriate, for details.

4.2.9. Can I make remittance requests at any time during the day?

Yes, you can make remittance requests anytime you wish.

4.2.10. Can I make amendments to my remittance request?

As the system will process the remittance request immediately, you cannot make amendments to your remittance request. If you need to amend the instruction, please contact any of our branches during business hours.

4.2.11. When will the transfer or remittance amount be deducted from my withdrawal account?

The transfer and remittance is processed online and the transfer amount is deducted from your withdrawal account immediately.

4.2.12. How do I know whether my immediate funds transfer has been successfully executed?

You can check your account balance using the [Account Enquiry] function after the transaction has been completed. Or you may check the status of the instruction at the first page of [Global Transfer]

4.3 Bill Payment

4.3.1. How do I make bill payments?

Before you can make bill payments, you must first open a Internet Banking account at one of our branches.

To make a payment to a particular biller, you need to first set up the biller using the [Add/Change Biller Account] function.

4.3.2. Can I make bill payment anytime?

You can make a bill payment anytime. Bill payment instructions made before the 12:00 a.m. local time will be debited from your account immediately and sent for processing on the next banking day. Bill payment instructions submitted during weekends, or on banking holidays will be debited from your account immediately and sent for processing on the following banking day.

4.3.3. What types of bills can I pay with Bill Payment service?

You can search the biller in [Add/Change Biller Account] function. Please make sure to use capital letters to search the biller.

4.3.4. Do I have to pay a transaction fee for making a bill payment?

There is no service charge for making a bill payment through Internet Banking. However, depending on your account features, a regular transaction fee may apply. Please refer to our Charge Schedule for Personal Customers or Charge Schedule for Business Customers, whichever is appropriate, for details.

4.3.5. How do I know whether my bill payment has been processed successfully?

You will receive an instruction number after you have successfully submitted a bill payment instruction.

You may check the status of a bill payment at the first page of [Bill Payment] function within the last 12 months. If the bill payment has been rejected, we will notify you by phone. The status of the particular instruction will be changed to [Failed] in [Bill Payment Enquiry] function within 2 business days after the submission.

4.3.6. What does bill payment status mean?

You may receive either "Successful" or "Failed" as the status of your bill payment shown in the [Bill Payment Enquiry] function.

"Successful" status indicates that the payment amount has been debited from your bank account. This status message appears in the Bank's record although the payment may not have reached your biller's account yet.

"Failed" status indicates that the debit of the payment amount from your bank account has been unsuccessful (e.g. due to insufficient funds).

Bill payment status may be changed from "Successful" to "Failed" if the bank is unable to deliver the bill payment to your biller (e.g. due to incorrect information provided for the bill payment instruction).

Rejected bill payment amounts will be refunded to your withdrawal account if an amount has been debited from the account.

4.3.7. What will happen if I lose access while making a bill payment?

You generally lose the transaction information when your session is terminated for any reason. A payment transaction is only completed when you have received a confirmation page with a reference number. You may check the payment status by using [Bill Payment Enquiry] function.

4.3.8. What should I do if I accidentally submit my payment more than once?

You should contact one of our branches as soon as possible during banking hours. If the bill payment has not been sent for processing, we may be able to cancel the duplicate bill payment for you. However, if the bill payment has been processed, we suggest that you contact the biller directly for adjustment.

4.3.9. How long does it take to process my bill payment?

You should allow at least 5 banking days prior to your payment due date to process your bill payment.

4.3.10. When will the amount be deducted from my withdrawal account?

The request will be processed online and the payment amount will be deducted from your withdrawal account immediately, even during weekends or on bank holidays.

4.3.11. What will happen if my account does not have sufficient funds on the payment day?

If there are insufficient funds in your withdrawal account to cover the bill payment amount when the instruction is processed on the payment date, the instruction will be rejected immediately.

4.3.12. Why do I need to pre-register my bill account for some billers?

You do not need to pre-register bill account in our branches.

4.3.13. How do I modify / delete my bill account in Internet Banking?

You can modify/delete your bill account by using [Add/Change Biller Account] function.

4.4 Term Deposit

4.4.1. What information can I obtain from the [Term Deposit] function?

You can check your term deposit principal balances in this function.

4.5 Loan

4.5.1. What information can I obtain from the [Loan] function?

You can receive an overview of all your registered loan accounts. Principal balances, outstanding balances, interest rates, repayment history and repayment methods of your loan accounts.

4.5.2. How far back can I make enquires on my loan repayment history?

You can view your loan repayment history during the past 12 months.

4.6 Customer Service

4.6.1. What information can I obtain from the [Customer Service] function?

4.6.1.1. Personalized Setting

1. You can create shortcut menu in [Create Shortcut Menu] function.

2. For personal customer, you can also change Logon Option from Card No. to User name.

4.6.1.2. Security Centre

1. You can reset your logon password by using [Change Password] function.

2. You may also change your security question by using [Change Security Questions and Answers].

4.6.1.3. IBK Function Search

You can search the location of each function by inputting the function name.

4.6.1.4. Logon and Logout Detail Enquiry

For corporate customer, we will provide the service to let you know the logon and logout history.

4.7 Information Centre

4.7.1. What information can I obtain from the [Information Centre] function?

You can send and receive e-mail to and from the Bank.

4.8 Others

4.8.1. My Internet Banking account number is the same as my ABM card number. What should I do with Internet Banking if my ABM card is lost or stolen?

You should report your lost card as soon as possible. We will issue a new ABM card with a new card number to you. As your Internet Banking account number is the same as your ABM card number, we will then change your Internet Banking account number as well.

After the replacement of your ABM card, you can use your existing User ID, new debit card number and Internet Banking PIN to access the Internet Banking Service. However, for security reasons, we advise that you change your PIN as soon as possible.

4.8.2. Can I use Internet Banking if I have terminated the ABM Service?

Our Internet Banking Service and ABM Service are operated separately. Even if you have terminated the ABM Service, you can still enjoy Internet Banking.

5. Security Advice

5.1 Is Internet Banking secure?

Industrial and Commercial Bank of China (Canada) Internet Banking has a number of security measures to safeguard your financial information:

Personal Identification Number (PIN)

You must enter the correct account number and PIN every time you want to access your Internet Banking Account. When you login to Internet Banking for the first time, you are required to change your PIN. We advise that you change the PIN periodically.

Dynamic Password Card

You must enter the correct dynamic password every time you do transactions or change any personal information. The dynamic password card is temporarily disabled after 5 unsuccessful attempts. After 10 unsuccessful attempts, the dynamic password card will be permanently frozen. You have to replace your dynamic password card when your dynamic password card is permanently frozen or be used for 1000 times. We advise that you keep your dynamic password card in a secure place.

Automatic Exit

To protect against unauthorized access, the connection to Internet Banking will be automatically terminated if service has been idle for more than 15 minutes.

Account access is disabled after 3 unsuccessful login attempts

The Internet Banking account is temporarily disabled after 3 successively unsuccessful login attempts. It will be reactivated automatically in the next day. After 10 unsuccessful attempts, your Internet Banking account will be permanently frozen. Customers with permanently frozen accounts need to contact the Bank to re-establish access.

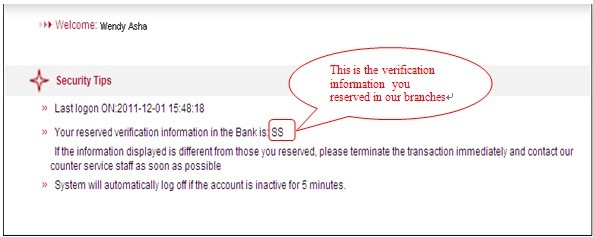

5.2 How do I verify that the website belongs to Industrial and Commercial Bank of China (Canada)?

You can verify our website in your internet banking [Customer Service] function. If the verification information in this page is as the same as you reserved in our branches, you are in the right website.

5.3 What should I do if I suspect that my PIN has been stolen or exposed?

For security reasons, you should change your PIN immediately. After that, you are advised to check all your account balances through the [Account Enquiry] function. If you find any discrepancies in your accounts, please contact us as soon as possible.

5.4 What should I do if I suspect that there has been unauthorized access to my Internet Banking account and/or unauthorized transactions have been submitted via my Internet Banking account?

In such an event, please contact us as soon as possible and provide us the details of the unauthorized transactions. We will also suspend access to your Internet Banking Account immediately.

6. System Requirement

Your browser should meet the following configuration:

| Items | Minimum Setting |

|

|

|

| Browser | IE |

| Browser Version | IE 6.0 |

| Operation System | Windows 2000 |